Once again, the US is facing a budget crisis as some hard-line Republican members of the House of Representatives are threatening to block any proposal that does not address the growing deficit in the Federal budget. The Washington Post details the size of the deficit:

“From August 2022 to this July, the federal government spent roughly $6.7 trillion while bringing in roughly $4.5 trillion. That represents a total increase in spending of 16 percent relative to last year and a 7 percent decrease in revenue, according to the Committee for a Responsible Federal Budget.”

These Republicans identify spending as the problem, but it more likely that revenues are declining becuase of tax cuts over the last 25 years. The Center for American Progress gives the specifics on how tax revenues have declined, even as spending as remained somewhat flat:

“Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues. In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more. If not for the Bush tax cuts4 and their extensions5—as well as the Trump tax cuts6—revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded. Eventually, the tax cuts are projected to grow to more than 100 percent of the increase.”

This insight needs to be kept in mind as the debate in Congress mindlessly repeats the same insipid mantras about how the US is living beyond its means. There is a great deal of money that escapes the attention of the Internal Revenue Service. Common Dreams, a reliable lefty think-tank, gives a rough idea of how much revenue is being lost to the IRS:

“Citing ‘alarming’ data provided by the federal government about the prevalence of tax evasion among the richest Americans, U.S. Sen. Ron Wyden on Thursday called on the Internal Revenue Service to crack down on ‘particularly brazen’ high-income tax cheats and noted that Democratic initiatives have already helped to begin addressing the problem.

“Writing to IRS Commissioner Danny Werfel, the Oregon Democrat and chair of the Senate Finance Committee cited data provided by the agency regarding taxes filed from 2017-20.

“More than 1.4 million wealthy Americans have still not filed their taxes for those years, Wyden said, with the total amount owed to the federal government reaching ‘a whopping $65.7 billion’—almost enough to fund a universal childcare program for one year or a universal school lunch program for more than two years.

“Nearly 1,000 people who earn $1 million per year or more have yet to file their tax returns, but Wyden wrote that the ‘most alarming’ revelation in the data provided to his committee by the IRS ‘was the extraordinary amount of unpaid taxes owed by a small subset of ultra-wealthy non-filers,’ with the 2,000 highest-earning tax dodgers currently owing $923 million.”

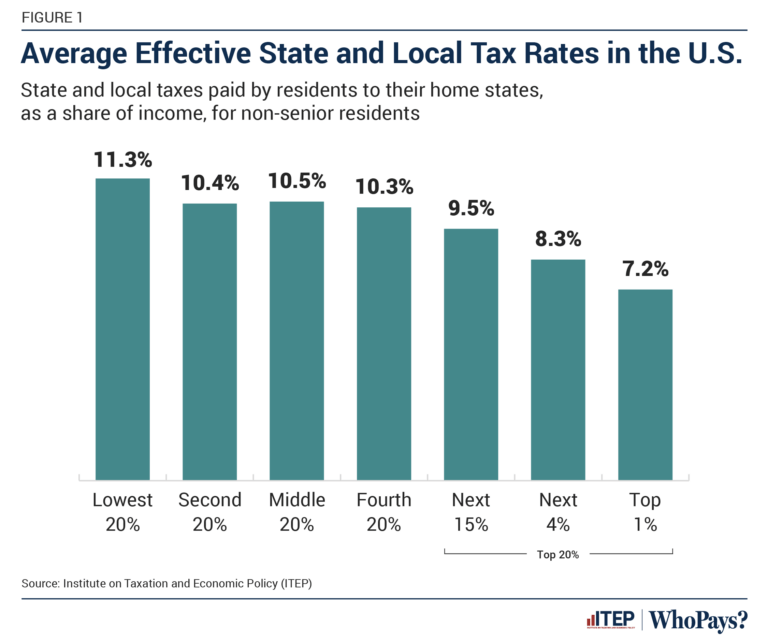

Moreover, the rich pay a substantially lower percentage of their income in taxes than do the poor. The effect is quite noticable when one looks at state and local taxes in the US. The Institute on Taxation and Economic Policy did an analysis of how wide the discrepancy actually is:

As the budget debate nears the 11th hour we should be telling Congress to take effective action to make everyone in the US pay their fair share. But do not hold your breath–the Congress is intent on bringing back feudalism.