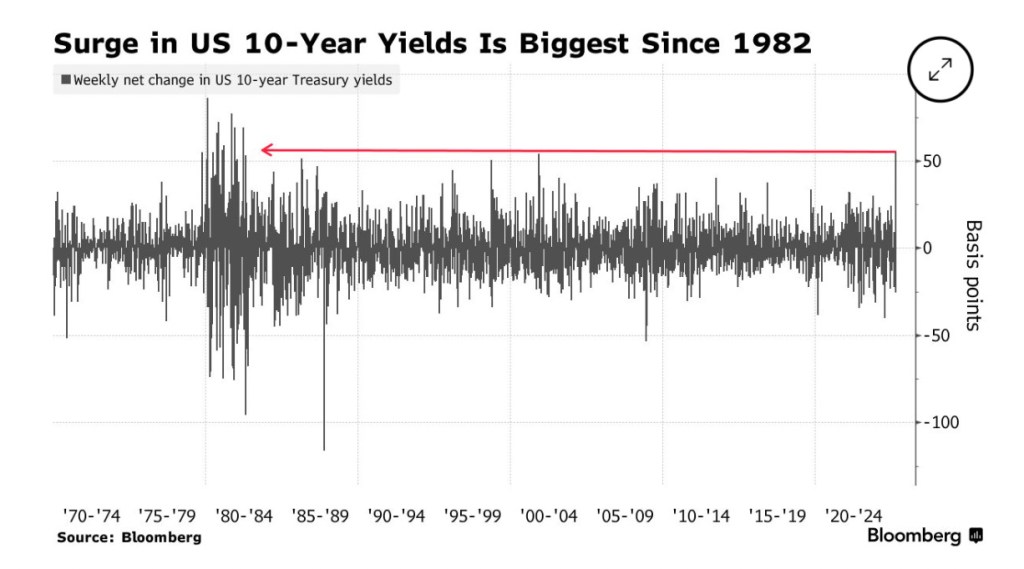

The world is experiencing an unusual event: US Treasury bonds are declining in price while the stock market declines as well. This asymmetry is rare because when the US stock market declines, investors typically buy bonds as a safer haven for their money. a pattern that usually raises the price for Treasury bonds. But last week bond price declines were dramatic. Typically, changes in bond yields are measured in very small increments. But last week, the yields increased by almost 0.5 percent. The spike is dramatic, and the New York Times reports:

“The yield on the 30-year Treasury bond rose 0.44 percentage points this week, trading roughly flat on Friday. The movement signaled a sharp shift in demand for the long bond. The Federal Reserve fixes a few very short-dated interest rates that then ripple out across financial markets. But the further away from the Fed’s rates you go, the less impact the central bank has.

“Typically, the nearly $30 trillion Treasury market is too large to be significantly affected by shifts in buying appetites, analysts said, highlighting just how severe the current moves in the market have been.”

It is impossible to determine the cause of this decline in bond value since the bond market is opaque because it is conducted by bond traders who do not have to disclose their buyers and sellers. The explanation for the decline, however, is that some investors do not believe that US Treasury bonds are safe. The actual economic data for the US economy is robust: unemployment is low, and inflation has yet to reach concerning levels. So the feelings of fear are rooted in some expectation that the US economy will soon be significantly weaker in the future. Moreover, there seems to be a sense in the markets that decision-making in the Trump Administration is deeply flawed.

Tfear can also be measured in the value of the US dollar. Bond yields usually track well with the value of the dollar, but last week there was an extraordinary divergence as evidenced by the graph below:

I cannot with any assurance extrapolate the likely consequences of this new and troubling development. The Economist makes the following observation:

“If bond yields were rising because of stronger American economic growth, they would bring about a stronger greenback. That the dollar is falling instead suggests investors are worried about America’s economic stability. It is an ominous repeat of a pattern that struck in Britain after Liz Truss’s disastrous “mini-budget” in 2022, which promised unaffordable tax cuts. Although Mr Trump’s tariffs raise money for the government, such revenue could be dwarfed by the higher payouts required by rising bond yields.

“Moreover, America’s budget is already in an awful state. Global demand for the dollar and Treasuries has enabled America to run a more extravagant budget than that which sparked the crisis in Britain. This special status is known as “exorbitant privilege”. The federal government’s net debts are worth about 100% of GDP. In the past 12 months, America has disbursed 7% of GDP more than it borrowed, and spent more on interest payments than on national defence. Over the next year officials must roll over debt worth nearly $9trn (30% of GDP).

“Now that privilege is under threat. Mr Trump’s tariffs are likely to cause deeper economic harm in America than elsewhere. They also reveal American policymaking to be arbitrary and capricious. Who can predict where tariffs will be in a week’s time? The sense of unease goes beyond economics. Mr Trump’s willingness to defund universities that house his critics, to withdraw government business from law firms which work with his legal opponents and to deport migrants to a prison in El Salvador without a hearing appears to threaten the norms on which American society has been built.”

My own view is that Trump has no idea what he is doing. His decisions on tariffs have been inconsistent, driven by a naive and uninformed understanding of the marketplace, and tainted by the strong stench of corruption as Trump makes exceptions for certain favored companies and individuals. I have no idea if this movement in the bond markets will continue. But watch the value of the dollar, the value of gold, and the yield on the 10-year Treasury bond. Lurking behind all this movement is the fact that China currently holds $759 billion of US Treasury bonds. It is unlikely that China will sell all those holdings quickly (to do so would mean that the Chinese would lose an awful lot of money). But the Chinese holdings are roughly equivalent to a nuclear threat to the US economy if it decided that the pain of losing money was less than the benefit of ending dollar pre-eminence in the global economy.